Prefer a Quick Summary? Watch this 40-Second Video to Catch the Key Points Fast.

Understanding Reserves: A Financial Guide for High-Risk Businesses

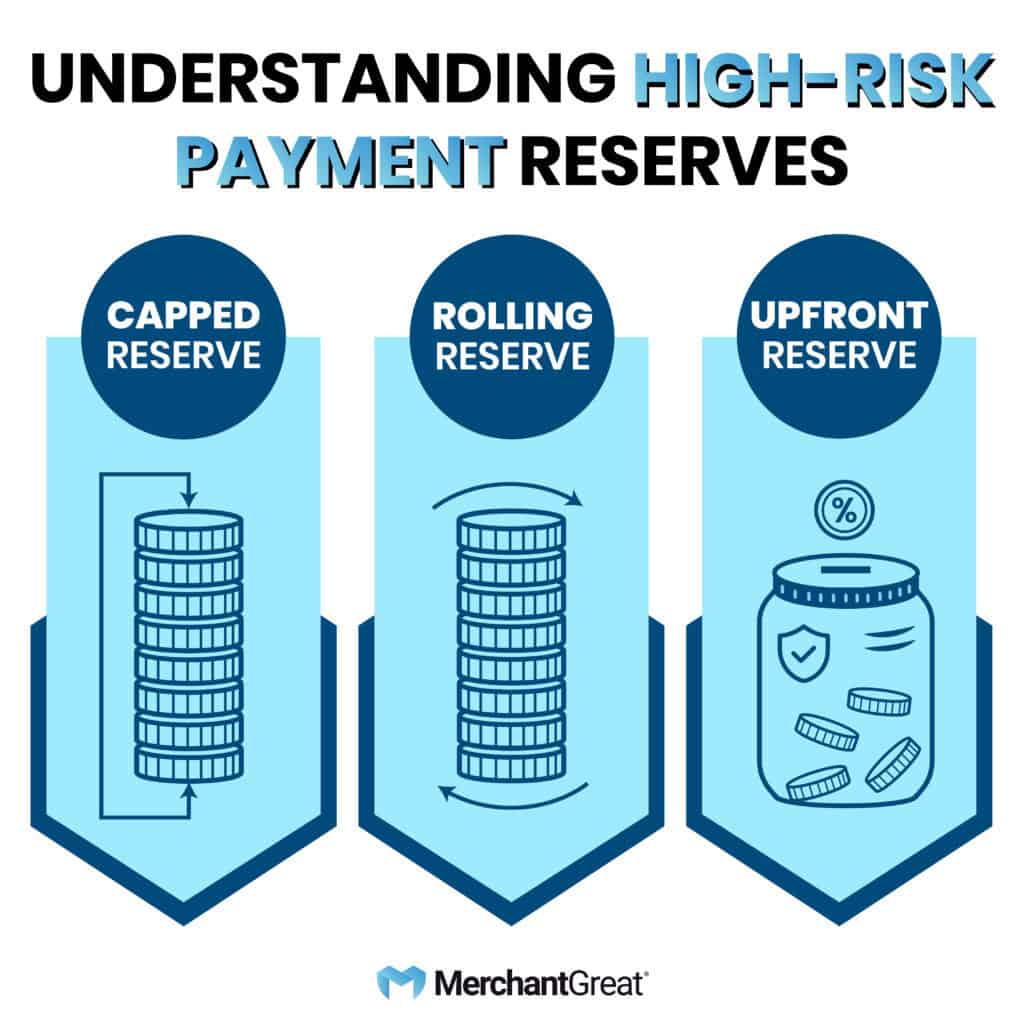

In high-risk payment processing, reserves play a critical role in managing financial risk, even though they can sometimes feel like a strain on your margins. There are three main types: capped, rolling, and upfront reserves. Understanding these financial tools is crucial for long-term success, especially in high-risk industries.

While reserves may seem like a frustrating obligation, they provide a necessary financial buffer that protects both your business and your payment processor from potential losses. In this guide, we’ll explore the significance of these different types of reserves, how they function, and why they can ultimately be beneficial to your business.

What is a Capped Reserve?

A capped reserve, also known as an accrual reserve, is a type of merchant account reserve that limits the amount of money withheld from your credit card sales to a predetermined percentage. The term “capped” refers to this limit. Once the reserve reaches this cap, no additional funds are held, and all future transactions are deposited directly into your bank account.

The primary purpose of capped reserves is to cover potential debts associated with chargebacks, fraud, or other financial liabilities. Since cardholders have up to six months to dispute a charge, processing banks must ensure that sufficient funds are available for any disputes. Additionally, capped reserves may cover balances from ACH returns if your bank account lacks sufficient funds.

Typical Capped Reserve Amounts

The amount held in a capped reserve varies based on the size and risk profile of your business. Typically, it is around half of your monthly processing limit. For instance, if your monthly processing volume is $50,000, your reserve cap might be $25,000. This ensures that enough funds are available to cover potential liabilities while not overly burdening your business.

On average, around 10% of your credit card sales are withheld until the reserve cap is reached. This percentage strikes a balance, providing necessary security while allowing you to maintain cash flow.

How Do Accrual Reserves Work?

Accrual reserves function by setting a cap on the amount of money that can be held from your merchant account at any given time. Until this cap is met, a portion of your sales is withdrawn and placed into a non-interest-bearing account. If your merchant account is closed, these funds will be used to settle any outstanding debts, protecting both you and the bank from potential losses.

This system creates a financial safety net, ensuring that unexpected financial challenges can be managed effectively. It also allows your business to operate with confidence, knowing that there is a buffer in place for unforeseen circumstances.

Hypothetical Scenario: Navigating Reserves in the CBD and Online Course Industry

Let’s consider a hypothetical scenario involving a business owner named Alex, who runs a successful e-commerce store selling CBD products and offers online courses on wellness and natural remedies. Alex’s business has grown rapidly over the past year, and with that growth came the need to secure a reliable payment processor to handle his increasing transaction volume.

Given the high-risk nature of both the CBD industry and digital products, Alex’s payment processor required a capped reserve of 10% on his sales, with a reserve cap set at $20,000. This meant that until Alex’s reserve reached $20,000, 10% of his sales would be withheld and placed into the reserve account.

At first, Alex was concerned about the impact this reserve would have on his cash flow, especially since he was planning to reinvest a significant portion of his profits into new product lines and marketing campaigns. However, he quickly realized the importance of this reserve as a financial buffer.

Managing the Reserve:

- Steady Growth: Over the next six months, Alex maintained a steady sales volume, and his reserve account gradually reached the $20,000 cap. Once this cap was reached, all of his subsequent sales were deposited directly into his business account, which allowed him to proceed with his expansion plans without further financial strain.

- Mitigating Risk: During this period, Alex focused on minimizing chargebacks by enhancing his customer service, clearly communicating his refund policies, and ensuring his products met the highest quality standards. This proactive approach reduced the risk of disputes and helped maintain a strong relationship with his payment processor.

Result:

- Long-Term Benefits: By effectively managing his reserves and maintaining a low chargeback rate, Alex was able to negotiate a gradual release of his reserve funds. After demonstrating consistent business performance, his processor agreed to release 20% of his reserve every three months, providing him with additional working capital to fuel further growth.

This scenario highlights how understanding and strategically managing capped reserves can not only protect your business but also provide opportunities for future expansion and financial stability.

How Are Reserve Funds Managed?

Funds for the reserve are taken as a percentage of each transaction. For example, if your reserve is set at 10% with a $25,000 cap, 10% of each transaction will be withheld until the reserve balance reaches $25,000. After hitting this cap, all subsequent funds will be deposited into your bank account without further withholding.

These reserve funds are held in a separate account by the processing bank, but you can monitor the balance on your merchant account statement. This transparency helps you keep track of your financial standing and ensures there are no surprises.

What Happens After Reaching the Reserve Cap?

Once the reserve cap is reached, the processor stops withholding a percentage of your sales. The funds remain in the reserve account until your merchant account is closed. If you maintain a good processing history, the bank will release these funds back to you.

If your processing volume increases, the reserve cap may be adjusted accordingly. For example, if your processing volume doubles from $50,000 to $100,000, the reserve cap might increase from $25,000 to $50,000. You would then need to continue contributing to the reserve until the new cap is met.

Capped vs. Rolling vs. Upfront Reserves

There are three main types of reserves to consider:

- Capped (or Accrued) Reserves: Common for businesses with lower risk profiles, these reserves are satisfied once the cap is met, providing a clear endpoint for the merchant.

- Rolling Reserves: Require a percentage of sales to be held each month, typically for a six-month period, creating a continuous financial buffer.

- Upfront Reserves: Necessitate a lump sum from the merchant at the start, usually for businesses with higher risk profiles. This upfront amount serves as an immediate buffer for the processor.

Why Choose Capped Reserves?

Capped reserves are generally considered the most manageable option because they involve the least amount of ongoing risk. Unlike rolling reserves, capped reserves don’t continue indefinitely, providing merchants with a clear endpoint. Additionally, they are less burdensome than upfront reserves, as you’re not required to deposit a large sum of money initially.

This makes capped reserves a more manageable option for many businesses, allowing them to maintain financial stability while meeting necessary requirements.

Understanding the Necessity of Capped Reserves

Capped reserves are often required for businesses with certain high-risk factors. If your business is asked to maintain an accrual reserve, it likely indicates some concerns identified during underwriting. However, the good news is that a capped reserve is typically a sign that the risk department sees limited threats associated with your business, opting for a capped reserve instead of a rolling or upfront one. This indicates a level of trust and confidence in your business’s ability to manage its finances and operations effectively.

Industries Likely to See Capped Reserves

High-risk businesses that typically require reserves are those with higher-than-average chargeback liabilities, either due to their industry or specific business practices. Some common sectors that often see capped reserves include:

- Travel (due to cancellations or disruptions)

- Contracting (where changes in work orders can impact payment)

- Transportation services (accounting for liabilities in transporting goods)

- Adult entertainment

- CBD products

- Gambling

- Pharmaceuticals

These industries often face higher levels of scrutiny due to the nature of their transactions and customer behavior patterns.

How to Get Your Reserve Funds Back

After hitting your reserve cap, you may be eligible for a release of funds, depending on your processing history and the bank’s policies. To negotiate a reserve release, contact your account manager, who can discuss the possibility with the processing bank. Many banks will consider releasing funds in stages if you’ve demonstrated reliability over time.

Maintaining open communication with your account manager and consistently demonstrating good financial practices can expedite this process.

Final Thoughts on Accrual Reserves

For high-risk businesses, reserves are a standard part of credit card processing. While these funds may feel restrictive since they can’t be immediately reinvested, they play a crucial role in safeguarding your business from unforeseen losses. Over time, as your business proves its reliability, you can work with your merchant services provider to negotiate the terms or release of your reserve.

Partnering with a provider that specializes in high-risk payment processing ensures you have the right support to navigate these challenges effectively. By approaching reserves with a strategic mindset and leveraging the benefits they offer, high-risk businesses can turn potential obstacles into opportunities for long-term success.

Unlock Your Business Potential with MerchantGreat

Navigating the complexities of reserves and high-risk payment processing can be challenging, but you don’t have to do it alone. At MerchantGreat, we specialize in providing tailored payment solutions that help your business thrive, even in the most high-risk industries. We’ve successfully helped our clients negotiate capped reserves, ensuring they maintain cash flow while meeting necessary financial requirements.

Ready to take control of your processing and unlock your business’s potential? Contact us today to learn how MerchantGreat can help you manage reserves, reduce risk, and maximize your profits.