Navigating High-Risk Banking: A Simplified Guide for Businesses

In today’s dynamic business environment, companies operating within high-risk industries face a unique set of challenges that can significantly impact their success. Whether you’re involved in subscriptions, CBD products, nutraceuticals, or high-volume transaction processing, securing a reliable payment processing partner isn’t just beneficial—it’s essential. High-risk businesses often encounter hurdles like higher fees, stricter regulations, and the looming threat of being placed on the MATCH list, which can severely limit their ability to process payments. However, understanding your risk profile and aligning with the right partners can transform these challenges into growth opportunities.

What is High-Risk Processing?

High-risk payment processing refers to specialized financial services tailored for businesses that financial institutions consider riskier due to a higher likelihood of financial setbacks. This elevated risk is often attributed to factors like frequent chargebacks, which are costly disputes that can damage relationships with payment processors. Chargebacks occur when customers contest a charge on their credit card, leading the bank to reverse the transaction, and they are more prevalent in certain industries.

Businesses deemed high-risk typically operate in sectors prone to higher fraud rates, elevated return rates, or those involving large transactions and recurring billing. Examples include online gaming, adult entertainment, CBD products, and emerging fields like cryptocurrency—industries where the nature of transactions inherently carries more risk. These sectors often deal with intangible goods, global customer bases, or regulatory ambiguities, all of which contribute to their high-risk status.

How Do You Know if Your Business is High-Risk?

Your business may be classified as high-risk if it operates in industries with a history of fraud or chargebacks, such as subscriptions, Nutraceuticals, or eCommerce. If you handle large transactions, offer recurring billing, or have faced issues with chargebacks in the past, you likely fall into this category. Understanding where your business stands is crucial to securing the support you need.

The Impact of Being a High-Risk Business

Being labeled high-risk can affect your business in several ways:

- Higher Processing Fees: Payment processors charge higher fees to offset the increased risk, which can eat into profit margins.

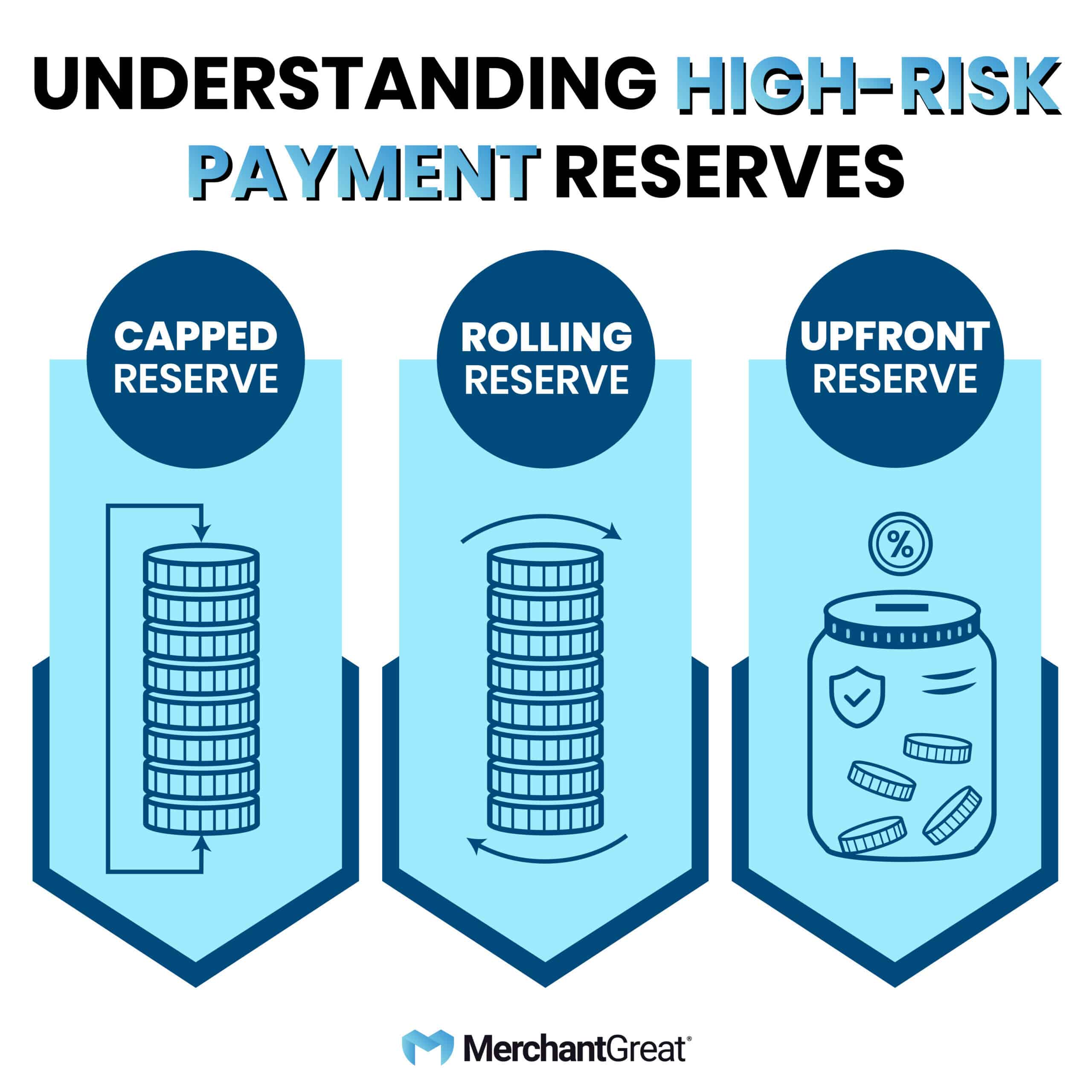

- Strict Contract Terms: High-risk merchants may face longer contract commitments, early termination fees, and rolling reserves where a percentage of sales is held back to cover potential chargebacks.

- Increased Scrutiny: You’ll likely face more stringent compliance checks and ongoing monitoring from financial institutions

- MATCH List Risks: Excessive chargebacks can land you on the MATCH list, limiting your ability to process payments and stifling your growth.

- How MerchantGreat Can Help

At MerchantGreat, we specialize in transforming challenges into opportunities by connecting your business with the right high-risk banking partners:

- Effortless Access to High Processing Capacity: Our streamlined pre-application process ensures you can start processing payments quickly. Within 30 days, you’ll be connected with banking partners that offer processing capacities of up to $1.5 million per month, giving your business the flexibility to grow.

- Unlock Unlimited Potential with One Application: With a single application, connect to over 15 top-tier banks offering competitive rates and unmatched reliability. Our scalable processing solutions come with no setup fees, empowering businesses in the US, Canada, and Europe to expand without limits.

Let us manage the processing challenges so you can focus on growing your business.

Why Choose MerchantGreat?

- No Setup Fees: Start processing payments without the upfront costs.

- Scalable Solutions: Our processing solutions evolve with your business, ensuring you have the support needed at every growth stage.

- Expert Guidance: With deep industry knowledge, our team is equipped to guide you through the complexities of high-risk processing, providing peace of mind and ensuring your business remains compliant and competitive.

Take Action Today

Contact MerchantGreat today and take advantage of our no-setup-fee offer to get started immediately. Don’t let the challenges of high-risk banking hold your business back. Partner with MerchantGreat and experience the difference a specialized approach can make. Let us be the partner that helps you navigate the complexities of high-risk banking, turning potential obstacles into pathways for growth.